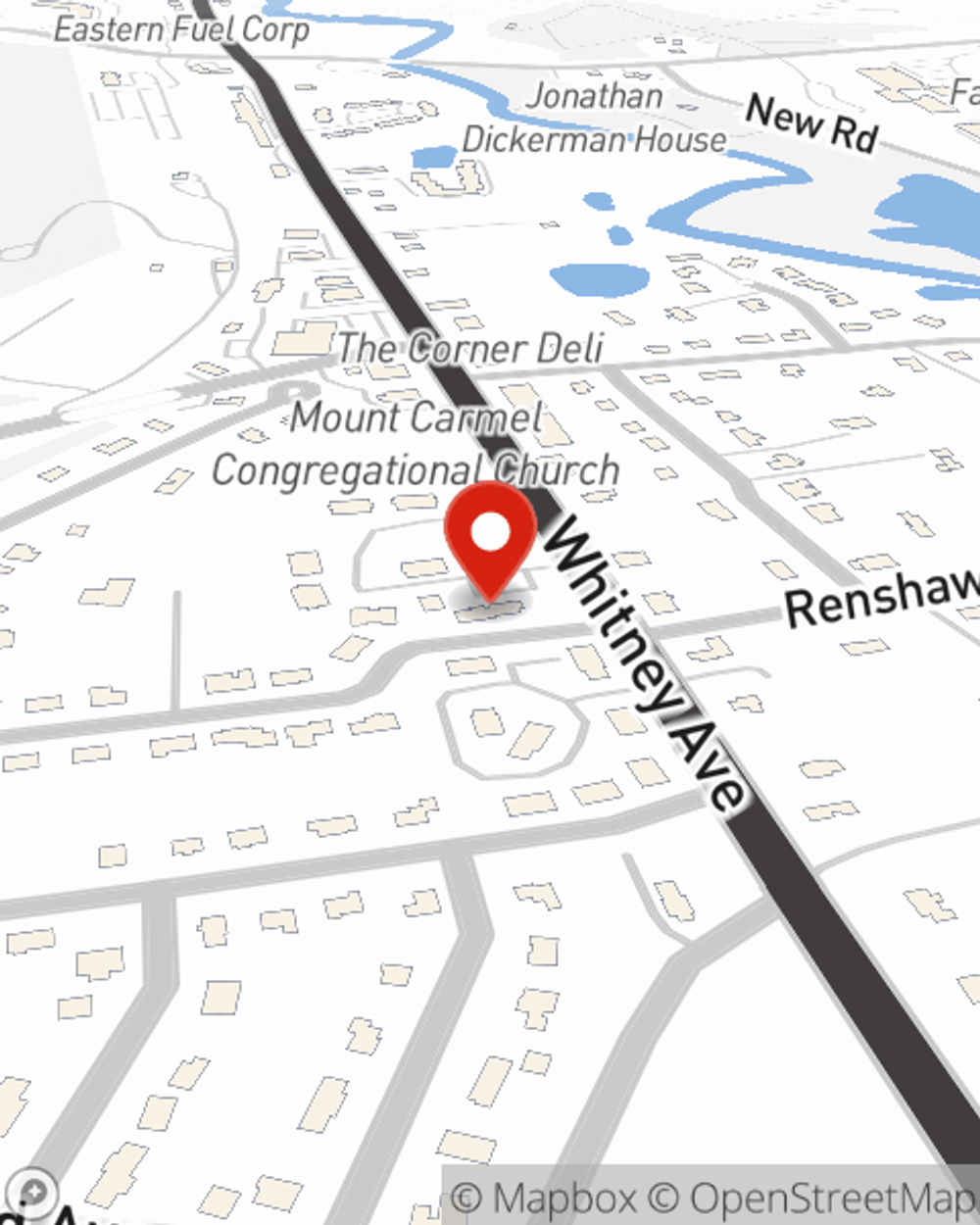

Condo Insurance in and around Hamden

Townhome owners of Hamden, State Farm has you covered.

Quality coverage for your condo and belongings inside

Your Search For Condo Insurance Ends With State Farm

When it's time to chill out, the home that comes to mind for you and your family and friendsis your condo.

Townhome owners of Hamden, State Farm has you covered.

Quality coverage for your condo and belongings inside

State Farm Can Insure Your Condominium, Too

We understand. That's why State Farm offers fantastic Condo Unitowners Insurance that can help protect both your unit and the personal property inside. Agent Deric Currie is here to help you understand your options - including benefits, savings, bundling - helping you create a customizable plan that's right for you.

When your Hamden, CT, residence is insured by State Farm, even if the unexpected happens, State Farm can help insure your condo! Call or go online today and discover how State Farm agent Deric Currie can help meet your condo unitowners insurance needs.

Have More Questions About Condo Unitowners Insurance?

Call Deric at (203) 407-1933 or visit our FAQ page.

Simple Insights®

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

Help protect yourself from contractor fraud

Help protect yourself from contractor fraud

Shady contractors and home repair scams can cost you. Discover tips to help protect yourself from repair scams and learn how to spot home repair fraud.

Deric Currie

State Farm® Insurance AgentSimple Insights®

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

Help protect yourself from contractor fraud

Help protect yourself from contractor fraud

Shady contractors and home repair scams can cost you. Discover tips to help protect yourself from repair scams and learn how to spot home repair fraud.